If you use mainstream media to keep abreast of current affairs, you would be forgiven for thinking that the UK is on the verge of bankruptcy because the pound is collapsing, interest rates are soaring, and a brutal recession is now an absolute certainty. For that seems to be the judgement of publications such as The Financial Times and The Economist as well as the opinion of the BBC, Radio 4, LBC and pretty much every other media outlet. All have rushed to repeat comments from ‘experts’ such as the International Monetary Fund (IMF), the Institute of Fiscal Studies, Larry Summers and Janet Yellen who have all described the UK as following economic policies befitting an emerging market. And all of the above are in total agreement that it is the fault of the new Prime Minister, Liz Truss, erstwhile Chancellor Kwasi Kwarteng and their mini-budget.

Now, whilst one can question the timing and communication of their policy announcements, I would like to put a little perspective on this.

General points

-

There is a reason that economics is known as ‘the dismal science’. As the quote below from JK Galbraith suggests, most economists have not got the slightest idea about the future and hence you would do well to ignore their prognostications. I speak as someone with a degree in Economics.

“There are two types of forecaster in economics. Those who don’t know and those who don’t know they don’t know.”

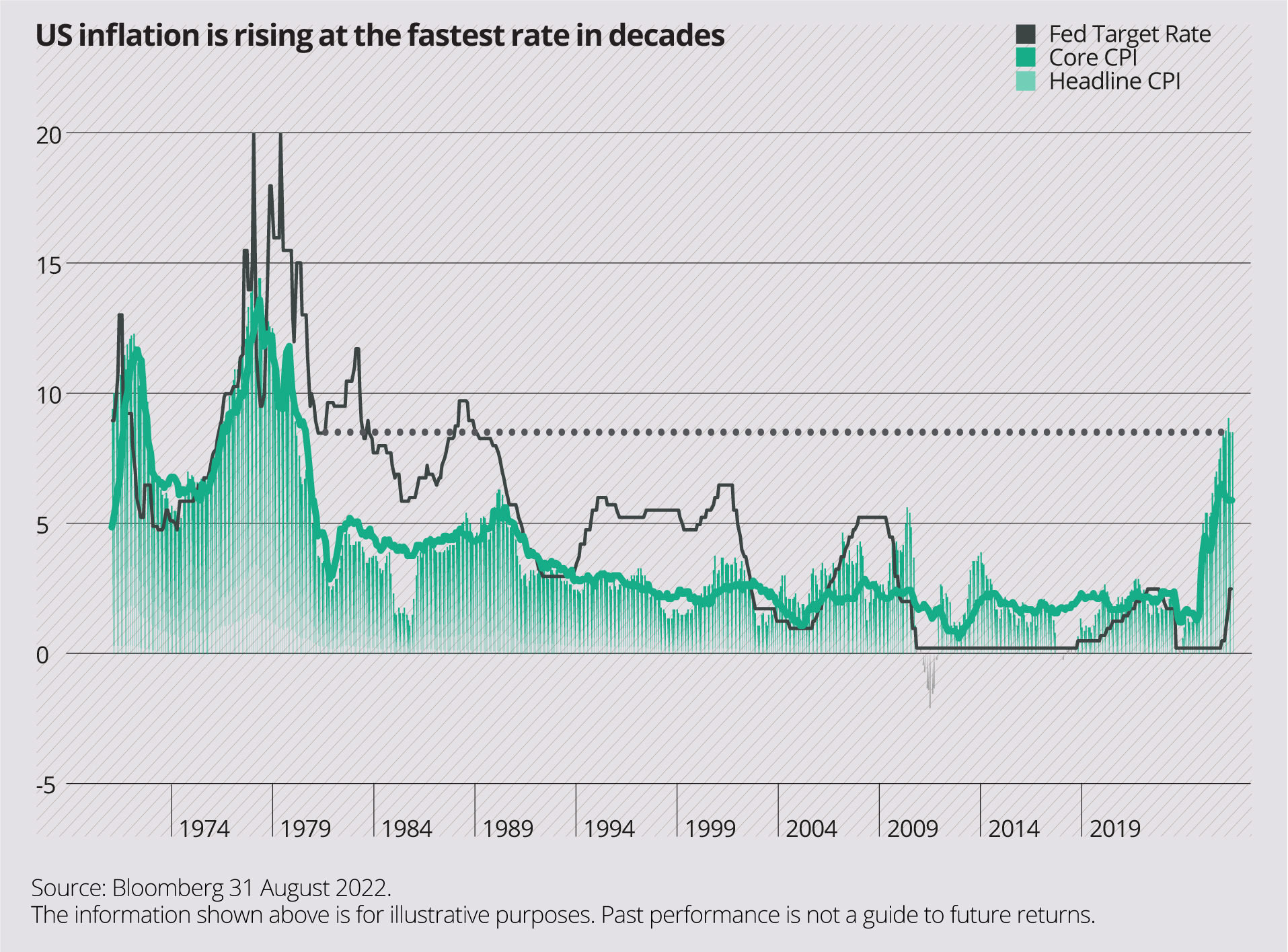

John Kenneth Galbraith - Given that many of the bodies mentioned above completely failed to predict the Global Financial Crisis and have spent the last few years telling anyone who would listen that inflation was transitory, why should we have such confidence in their forecasting ability now?

- You should always ask yourself whether those whose advice you are seeking have a vested interest. Many of the bodies mentioned above have been advocates of the economic model that has now been found wanting – ie cutting interest rates to zero, printing money to fund deficit spending, inflating huge asset bubbles which generally made the rich richer and increased inequality before eventually stoking inflation which hit the poorest in society the hardest. They are hardly likely to embrace any economic policies that seek to reverse this and have every incentive to find scapegoats for their own failures.

- It is a constant source of wonder to me how the media collectively elects to ignore the regular improprieties of the ‘experts’ it chooses to cite. Larry Summers famously fought against the proposal that derivatives should be regulated, only for the final report of the Financial Crisis Inquiry Commission convened by Congress in 2009 to place the government’s failure to rein in these derivatives at “the centre of the storm “.[1] The IMF itself is hardly a paragon of virtue. Former head, Christine Lagarde, was convicted several years ago for negligence with public funds while she was France’s finance minister in a major fraud case. Rodrigo Rato, who served as IMF chief from 2004 to 2007, was imprisoned in Spain for embezzlement in 2018. And this is before we even mention the string of allegations made against Dominique Strauss-Kahn, who led the fund from 2007 to 2011 and was forced to resign as a result of the scandals.

So, you will forgive me if I don’t hang off every word uttered by these commentators, and I would be fascinated to know why mainstream media treats them with such reverence.

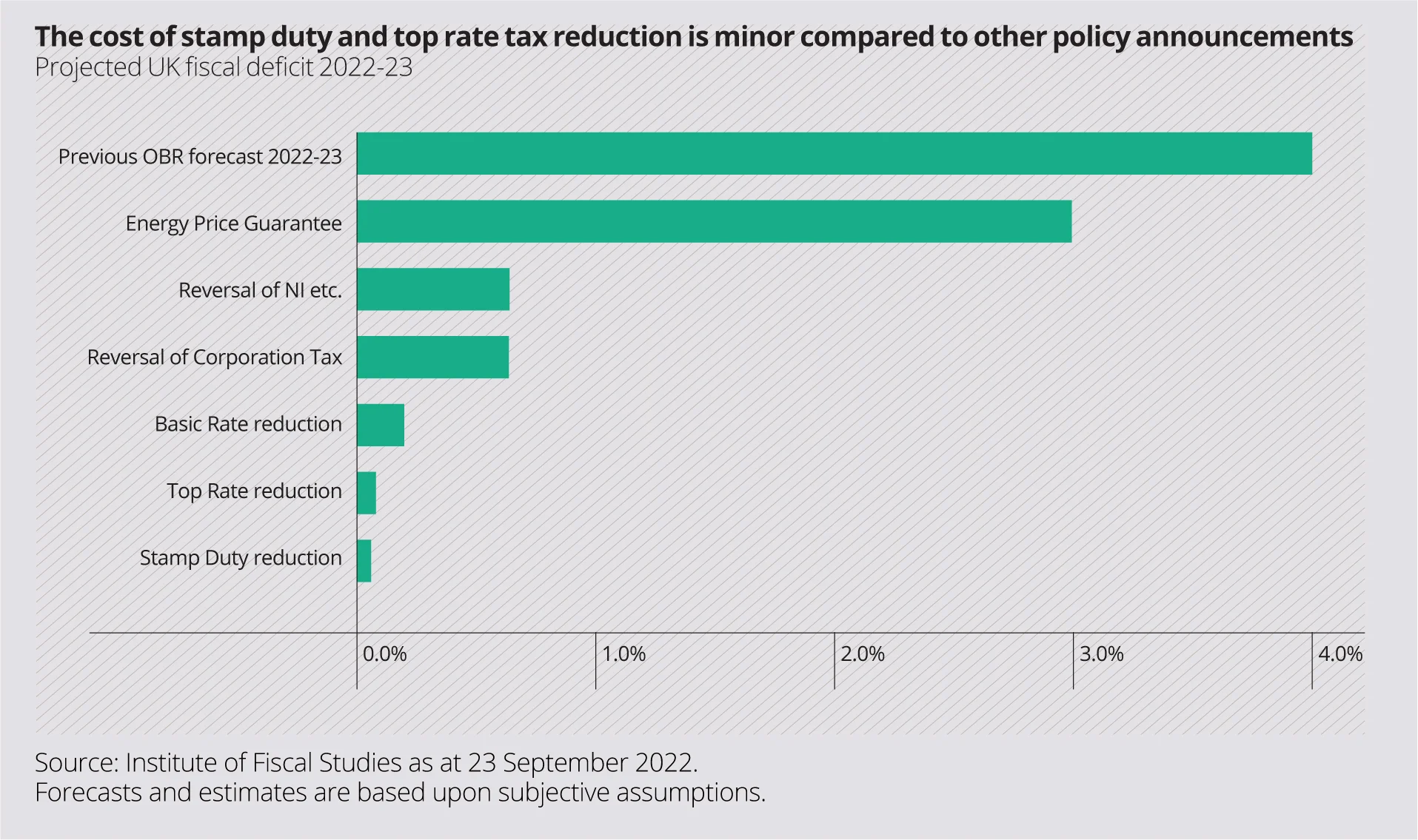

Turning to the mini-budget, the oft-cited reason for the meltdown in the Gilts market that followed it was ‘unfunded tax cuts’. However, a look at the timing of the various announcements calls that narrative into question. The market already knew about the Energy Price Guarantee, and the repeal of the announced hikes in corporation tax and national insurance which collectively amounted to £92bn (and so did all the institutions mentioned above who didn’t object to them). So, we are supposed to believe that it was just the addition of the abolition of stamp duty (cost c. £1.5bn) and resumption of 40% top rate tax (cost c. £2bn) that sent the market into a tailspin. It is sometimes said that it was “the last straw that broke the camel’s back”, but it does seem rather incredulous to think that c. £3.5bn on top of c. £92bn of additional borrowing would have such a significant market impact.

The doom-mongering about the UK has reached levels rarely seen before, but the reality is not nearly as scary as the harbingers of doom would have you believe. The UK has the second lowest ratio of debt to GDP of the G7 and headline inflation, while elevated at 9.9%, is below the eurozone average. The UK is not currently in recession having grown by 0.2% during the three months to June and many believe that the economy could narrowly escape falling into recession whilst unemployment is at a 44-year low. You may also not have heard the good news on gas prices which have plummeted in the last few months. The spot price of wholesale gas in Europe is even lower than the December futures price and if it remains at today’s level, it will fall below the strike level where the state subsidy kicks in. This would eliminate the burden for the Exchequer entirely (the largest line in the chart above).

So, what is the cause of all this market volatility?

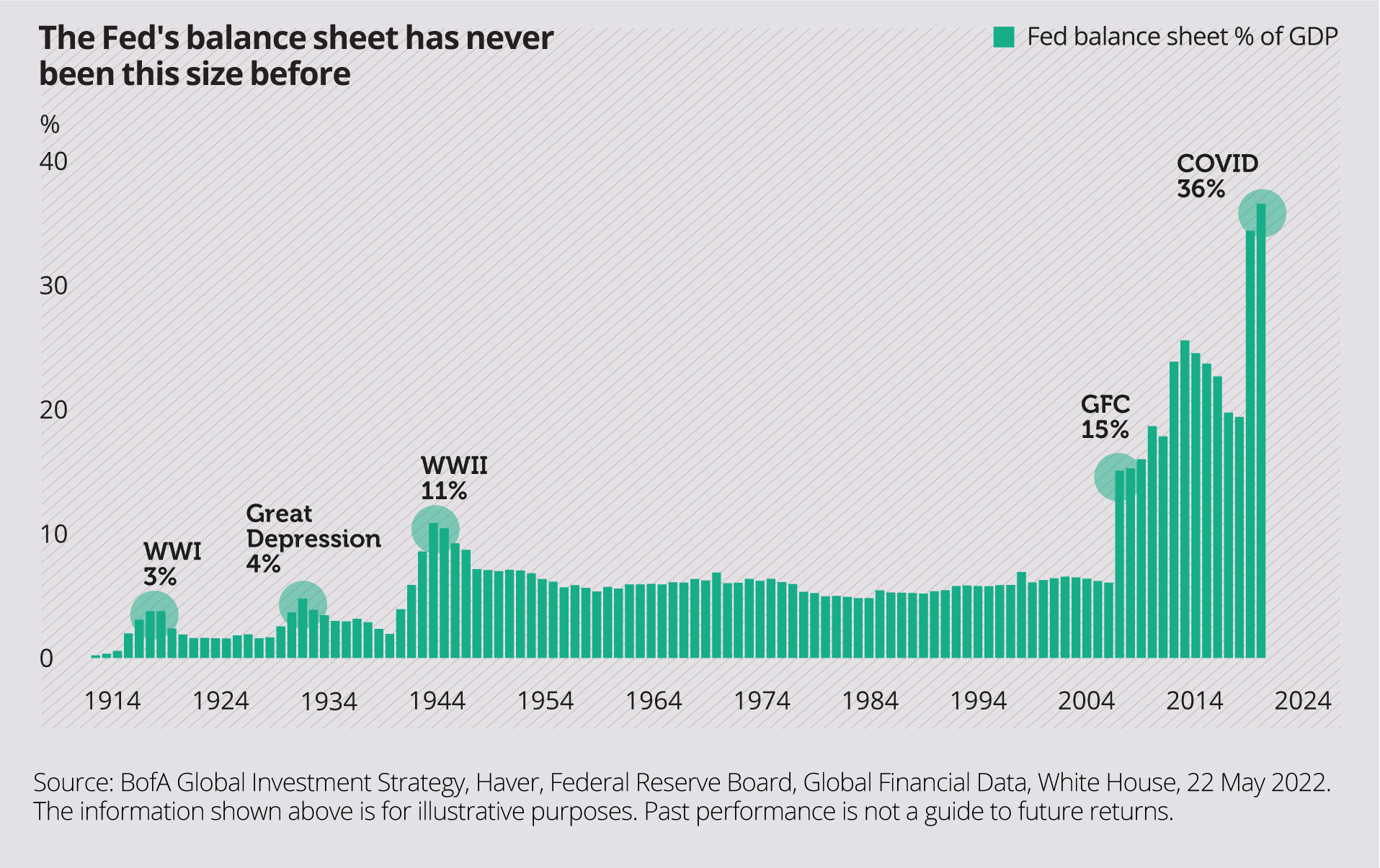

The reality is that the UK, as well as the US, Europe, and Japan have spent the last decade carrying out a gigantic economic experiment which appears to have failed. Interest rates have been kept at artificially low levels by central banks who also printed money into existence in a mechanism known as quantitative easing.

This stoked up bubbles in equities, bonds and housing but, for a while, did not cause consumer price inflation. The pandemic changed all this when governments ran massive fiscal deficits (again funded by central banks) which actually injected money into the real economy. This, when combined with the supply shortages that resulted from locking down the world economy for two years, eventually produced the highest inflation for forty years.

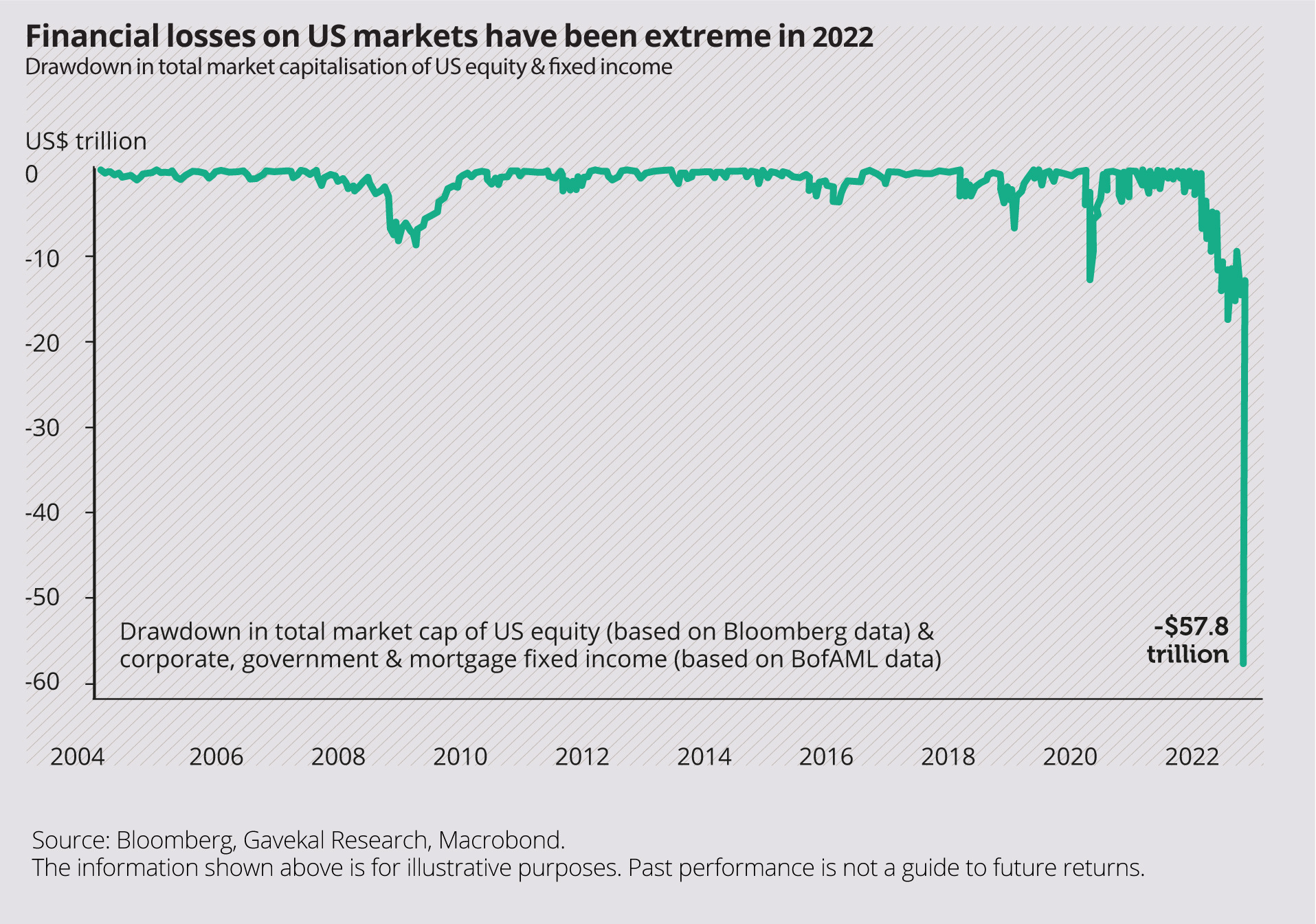

Central banks, including the Bank of England, initially took no action against this and spent two years assuring everyone that the inflation was ‘transitory’ before eventually waking up to the fact that it wasn’t. This has meant they are now having to make up for lost time by slamming the brakes on the economy in order to reduce the rate of inflation. As a result, the drivers of the asset bubbles (low interest rates and money printing) were first paused and have now gone in to reverse, thus deflating those bubbles.

This explains why bond yields are going up everywhere and why equity markets are coming down everywhere. This is a global phenomenon which we believe has very little to do with the fact that the Chancellor sought to reduce top rate income tax from 45% to 40%.

What does this all mean for the Trust?

Now you might at this stage be saying “that’s fascinating but what does it all mean for Temple Bar?”. The father of value investing, Benjamin Graham, famously said “In the short run, the market is a voting machine but in the long run, it is a weighing machine”. What he meant by this is that share prices will reflect market sentiment in the short run, which means that they will tend to be low when the narrative is gloomy and high when the prevailing sentiment is optimistic.

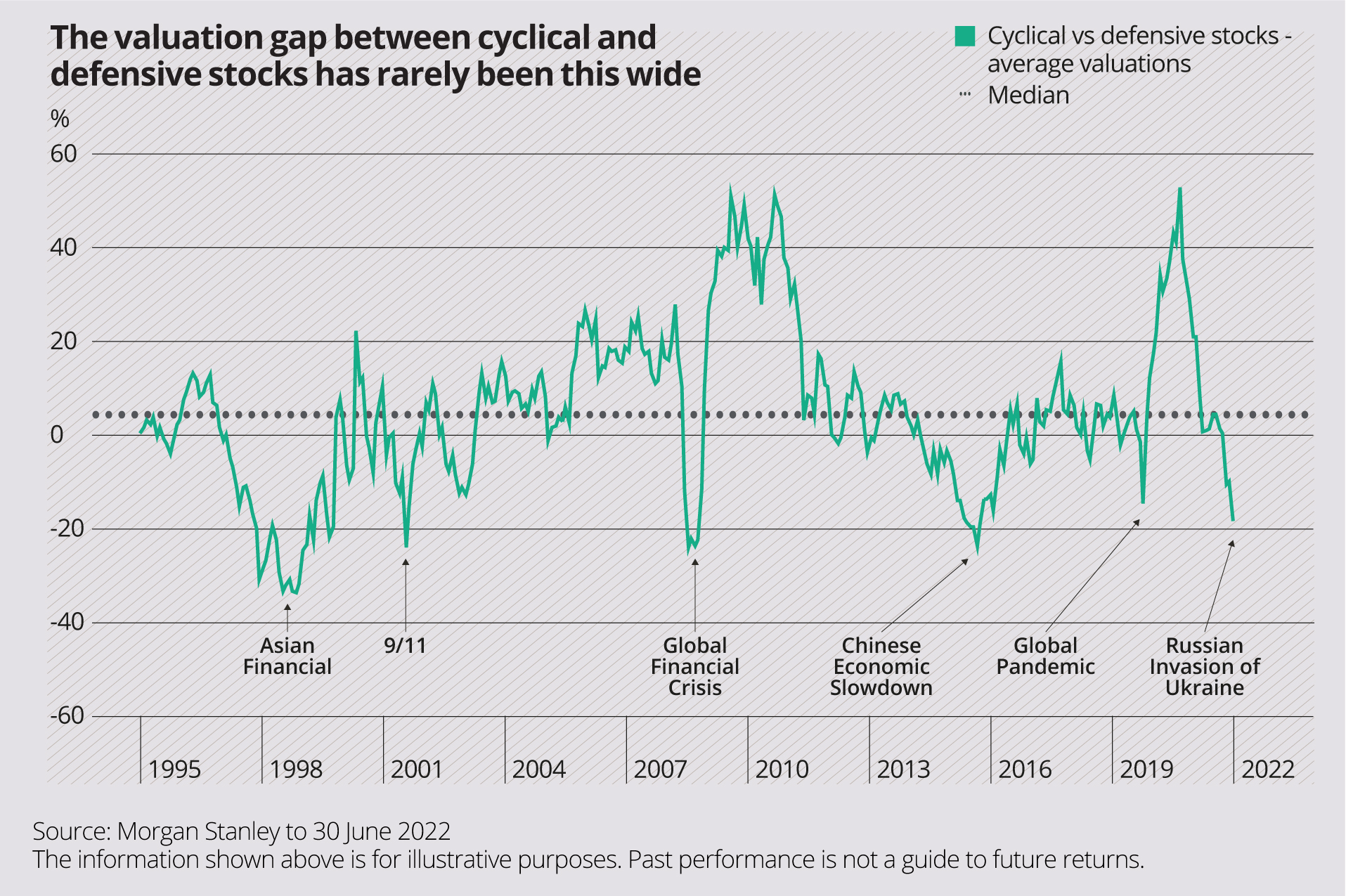

Right now, share prices are being impacted by the sort of narrative described above, which understandably has created a sense of panic with predictable impacts. Fearing an economic decline, many investors have stampeded out of anything remotely cyclical and into defensive stocks. This has driven down the valuations of cyclical stocks to levels that arguably make no sense unless the economy is never going to recover.

The chart below shows the gap between the valuation of cyclical and defensive stocks over time. It also highlights the economic or political events that led to this market dislocation. You will notice that the valuation gap is nearly as wide as it has ever been and that, in all previous cases, investors were subsequently rewarded by buying the cheap cyclicals, not the expensive defensives.

Rather than form a long-term view of the valuation of many businesses quoted in the stock market and taking advantage of the fact that the recent panic has created an opportunity to buy them for less than they are potentially worth, it seems that many are allowing price action to influence their own behaviour. The institutional imperative, and a desire not to look too different from one’s competitors, seems to be driving many investment decisions rather than a desire to take the best course of action for underlying investors. Many asset allocators seem incapable of stomaching any fluctuations in a company’s profitability or volatility in share prices and therefore stability, which is much sought after, has become over-valued whilst volatility is undervalued.

Since we are not unduly concerned about variation in short-term profits nor share price volatility, we regard this as a very attractive investment opportunity. Warren Buffett has frequently stated that some of his most successful investments started during periods of heightened political or economic risk as it was precisely that uncertainty which provided him with an attractive entry point.

“We will continue to ignore political and economic forecasts which are an expensive distraction for many investors and businessmen. Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%. But surprise: None of these blockbuster events made even the slightest dent in Ben Graham’s investment principles. Nor did they render unsound the negotiated purchases of fine businesses at sensible prices. Imagine the cost to us, if we had let a fear of unknowns cause us to defer or alter the deployment of capital. Indeed, we have usually made our best purchases when apprehensions about some macro event were at a peak. Fear is the foe of the faddist, but the friend of the fundamentalist”

Warren Buffett, 1994 letter to Berkshire Hathaway shareholders

We realise that this course of action is unlikely to be popular in the short term, and that articulating an investment strategy of buying ‘wonderful businesses’ at any price is currently the easier route to asset raising, but the fact that we have always been willing to go contrary to perceived wisdom has been one of the key reasons behind our long-term returns. We see no reason why that should change now.

Historically, our best periods of performance have come in the aftermath of uncertainty similar to that which we are seeing right now. This leaves us very confident about the long-term outlook for Temple Bar from here, albeit the near-term is even more inscrutable than usual.

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. Information contained in this document should not be viewed as indicative of future results. The value of investments can go down as well as up.

This document is issued by RWC Asset Management LLP (Redwheel), in its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. Redwheel, is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission.

Redwheel may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. Redwheel seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This article is directed only at professional, institutional, wholesale or qualified investors. The services provided by Redwheel are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by Redwheel; or (iv) an offer to enter into any other transaction whatsoever (each a Transaction). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party. Redwheel bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction.

[1] Final report of the National Commission on the causes of the financial and economic crisis in the United States, January 2011

How to Invest

The Company’s shares are traded openly on the London Stock Exchange and can be purchased through a stock broker or other financial intermediary.