Ian Lance

Portfolio Manager

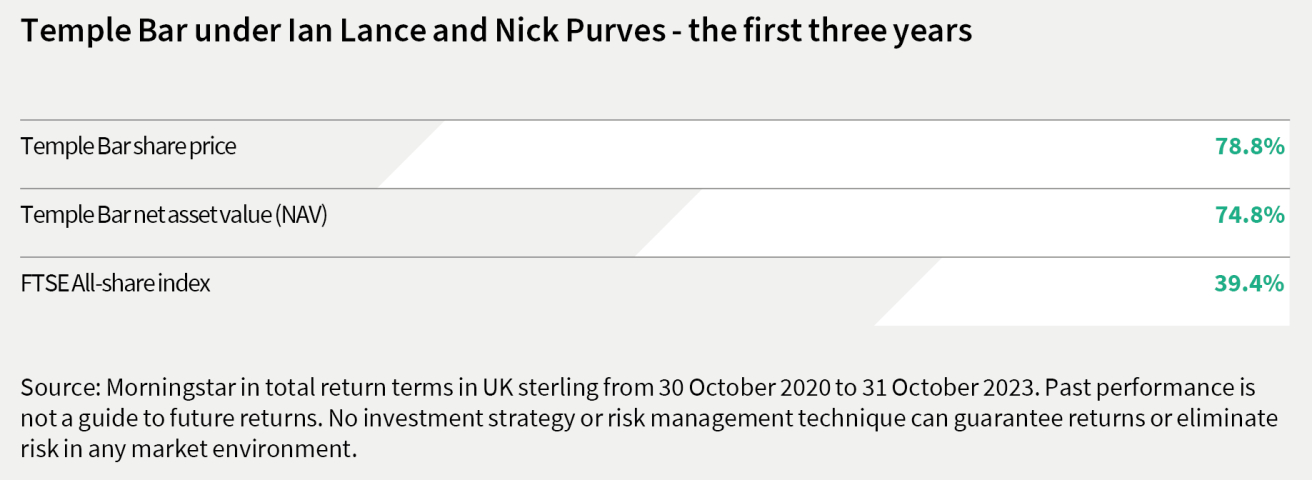

As this quarter marks the third anniversary of Nick and I taking over the management of Temple Bar Investment Trust, we thought we would take the opportunity to reflect on the last three years, discuss the lessons we have learnt and then finally explain how the trust is positioned for the opportunity that we see ahead of us.

A turbulent start

Time dulls the memory and hence it is very easy to forget just how turbulent everything was – not just financial markets – in the summer of 2020 during the pandemic and accompanying lockdown. By way of illustration, our first face-to-face meeting with the Temple Bar board took place in the open air at a suitable social distance. On the way to the meeting, I took a photo of an underground platform at Leicester Square at 8:00 in the morning where I was one of only two people commuting.

It is also easy to forget the level of fear in the stock market at that time. This is perhaps best demonstrated by the fact that the share price of NatWest Bank (formerly RBS) declined to the same level that it had reached in early 2009 during the financial crisis, shortly before the UK Government had to step in and part-nationalise it1. Having spent the subsequent decade rebuilding its balance sheet, there was little real possibility that NatWest was actually insolvent. Rather, many investors were so fearful of the economic impact of the Government’s pandemic response that they were willing to sell cyclical stocks almost regardless of how lowly-valued they had become and buy defensive stocks regardless of how highly-valued they were.

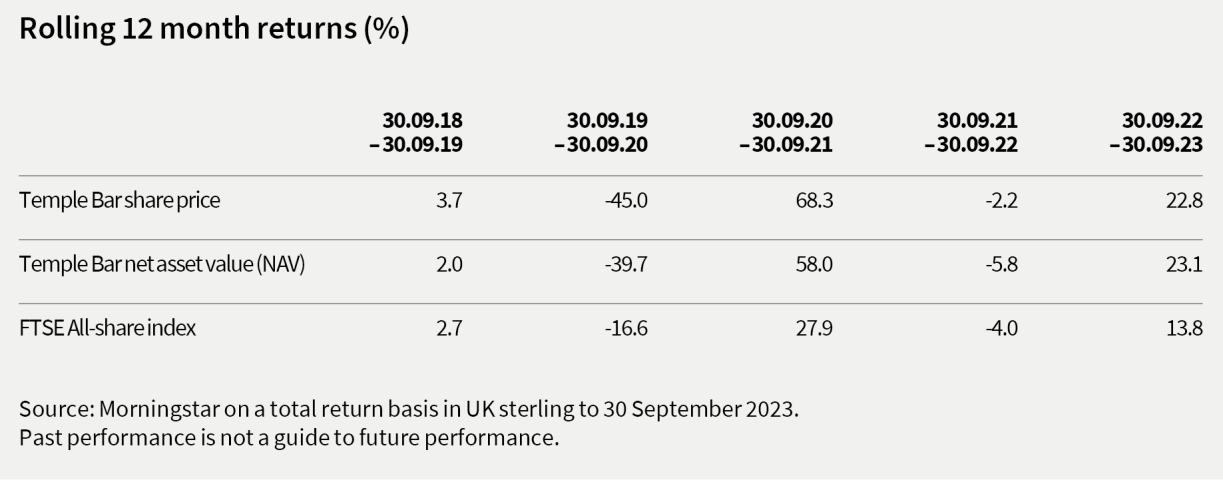

Needless to say, this was a terrible period for those of us who followed a value style of investing although, as we shall see below, it also provided one of the best opportunities to buy undervalued stocks in a decade and set up the strong returns of the last three years.

It was against this background that the trust’s board were deciding to change portfolio manager and one should not underestimate the scale of the courage required to stick with a value investing strategy following a period in which it had been so out of favour (some other boards appointed high-flying growth managers at this time). As the returns below demonstrate, however, it was indeed fortuitous for shareholders that they did.

Investing away from the herd

We are pleased with the investment results delivered since we took over management of the trust and we hope that, as shareholders, you are as well. Furthermore, there are three important conclusions we can draw from these results, all of which seem to run counter to the current prevailing narrative.

1. Valuation matters

The mantra of many asset allocators over the last few years has been to ‘go global’ when it comes to equity investment. The US now represents nearly 70% of the MSCI World Index2, so this effectively means allocating the majority of a portfolio’s equity exposure to the US, with minimal exposure to other regions such as the UK. This has been one of the factors behind the relentless selling of UK equities over the last few years which has occurred despite the fact that UK equities have traded at a significant and increasing valuation discount to US equities. We believe, however, that the figures above suggest that, when purchased at low valuations, UK equities can still generate very attractive returns for investors. Indeed, the UK has actually outperformed the US over the last three years3.

2. Discipline is key

As money flooded into mega cap technology stocks and drove their share prices higher, many growth investors were quick to sound the death knell of value investing. We believe that the results of the trust over the last three years demonstrate that a value strategy can still generate significant excess returns if applied with discipline. Indeed, one of the keys to a successful value investing strategy is the ability to stick with it during periods that it is out of favour and being written off by market commentators.

3. Active management can add value

Another investment maxim that has become popular in recent years is that it is not worth paying for active management since very few fund managers can beat the index. Thus, the logic goes, investors should just buy low-cost passive funds. Again, we believe the recent results of the trust suggest that active management can still produce a return after fees that comfortably beats the index. Hence, it is worth paying for active management – as long as you choose the right manager.

The best may be yet to come

Having seen the share price of the trust go up by almost 80%, it would be tempting to conclude that the best must be behind us. We do not believe this to be the case and are firmly convinced that the trust, as it is currently positioned, has the ability to generate good returns for shareholders for years to come.

What gives us this confidence is, as always, the very low starting valuations that characterise so many of the holdings in the trust’s portfolio. One of our most recent purchases for the portfolio is the auto manufacturer, Stellantis, which is valued on a price-to-earnings ratio of 3x, although when one adjusts for the fact that the company has cash on its balance sheet, the enterprise value to operating profit ratio is just 1.5x. In addition, the company pays a dividend that is 8.5% of the share price at the moment. Contrast this with another auto manufacturer, Tesla, which currently trades at 80x earnings despite the fact that the two companies have similar levels of profitability (c.11% operating profit margin).

This is, however, just one example of the many lowly-valued stocks held by the trust. High quality banks such as NatWest are available for purchase at a price-to-earnings ratio of 5x and a dividend yield of nearly 9%. Energy company Centrica is currently valued at 5x earnings but, like Stellantis, has a considerable amount of cash on its balance sheet and once adjusted for, is valued at an enterprise value to operating profit of 2.5x4.

Past performance is, as we are all regularly told, not a reliable guide to the future. But Nick and I believe it is important that you understand the confidence that we have in the Temple Bar portfolio and the considerable potential that it holds. When we can put together a reasonably diversified portfolio of businesses trading at these sorts of valuations, the subsequent investment returns are usually very satisfactory. We see no reason to believe that this time will be any different. We are, therefore, hopeful that the next three years may be at least as rewarding as the first three years, if not more so.

Thank you for your ongoing support.

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. Information contained in this document should not be viewed as indicative of future results. The value of investments can go down as well as up.

This article is issued by RWC Asset Management LLP (Redwheel), in its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. Redwheel, is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission.

Redwheel may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. Redwheel seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by Redwheel are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by Redwheel; or (iv) an offer to enter into any other transaction whatsoever (each a Transaction). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party. Redwheel bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction.

1 Source: Koyfin. NatWest closed at the same effective share price of 93p on 23 January 2009 and 30 September 2020.

2 Source: Morgan Stanley as at 30 September 2023.

3 Source: Morningstar, Bloomberg, based on total returns in local currency of 39.4% and 34.4% delivered by the FTSE All Share Index and S&P 500 Index respectively, from 30 October 2020 to 31 October 2023. Past performance is not a guide to future returns.

4 The source of all valuation data in this section is Bloomberg as at 30 September 2023.

How to Invest

The Company’s shares are traded openly on the London Stock Exchange and can be purchased through a stock broker or other financial intermediary.