Since we believe that fund manager ‘start of year outlooks’ are rarely of any use, we do not intend adding to the dozens that have already been published. Instead, our natural contrarian instincts inspire us to look backwards rather than forwards, so below we review what we were saying early last year and how it has turned out.

In one of our newsletter articles last year, called ‘The return of the total return kings’, we identified two catalysts that we thought could realise some of the significant levels of value that we observed in the UK equity market – corporate takeovers and share buybacks. So how did that work out?

1. Corporate takeovers

In the previous note, we stated the following:

“The relentless selling of UK equities has driven valuations to such low levels that overseas corporates have spotted an opportunity to acquire UK assets at prices that offer serious future return potential.”

Indeed, 2024 turned out to be a year in which UK plc had its ‘Barbarians at the gate’ moment1 as overseas corporate buyers and private equity firms took advantage of the low valuations of UK businesses created by the valuation-agnostic selling of UK equities. The trust benefited from this activity, with IDS and Direct Line being taken over, whilst Currys and Anglo American received approaches that they successfully rebuffed.

2. Share buybacks

In the same note, we demonstrated how firms consistently buying back lowly valued shares can create significant value through the case study of Next plc, highlighting how some of our current investments had the ability to replicate this (hence the title ‘The return of the total return kings’.)

Having urged many of the companies that we invest in to take advantage of their lowly valued shares, we were delighted to see many of them implement share buyback policies in 2024, often with considerable benefits to remaining shareholders. The biggest successes were NatWest and Barclays, which reduced their share count by 9% and 5% respectively and saw their share prices rise by 83% and 72%2.

Where does this leave us now?

As previously mentioned, the share prices of several stocks in the trust portfolio rose considerably during 2024. Some were the result of bid activity, others were beneficiaries of consistent and sizeable share buybacks. This may prompt some investors to reflect on their strategy as we transition from one year to the next, but we believe this would be a mistake driven by a cognitive bias known as anchoring.

The anchoring effect is “a psychological phenomenon in which an individual's judgments or decisions are influenced by a reference point or ‘anchor’ which can be completely irrelevant”.3 In one famous study by Amos Tversky and Daniel Kahneman4, participants were asked to estimate the percentage of African countries in the United Nations. Before estimating, the participants first observed a ‘wheel of fortune’ that was rigged to stop on either 10 or 65. Participants whose wheel stopped on 10 guessed lower values (25% lower on average) than participants whose wheel stopped at 65 (45% higher on average). Thus, their estimates were influenced or ‘anchored’ off a data point that had no relevance to what they were being asked to forecast.

Similarly in the stock market, investors tend to anchor off certain share prices which actually contain little information about the value of the stock they are analysing. Instead, we would argue that current valuations are a better guide to future returns than historic or current share prices.

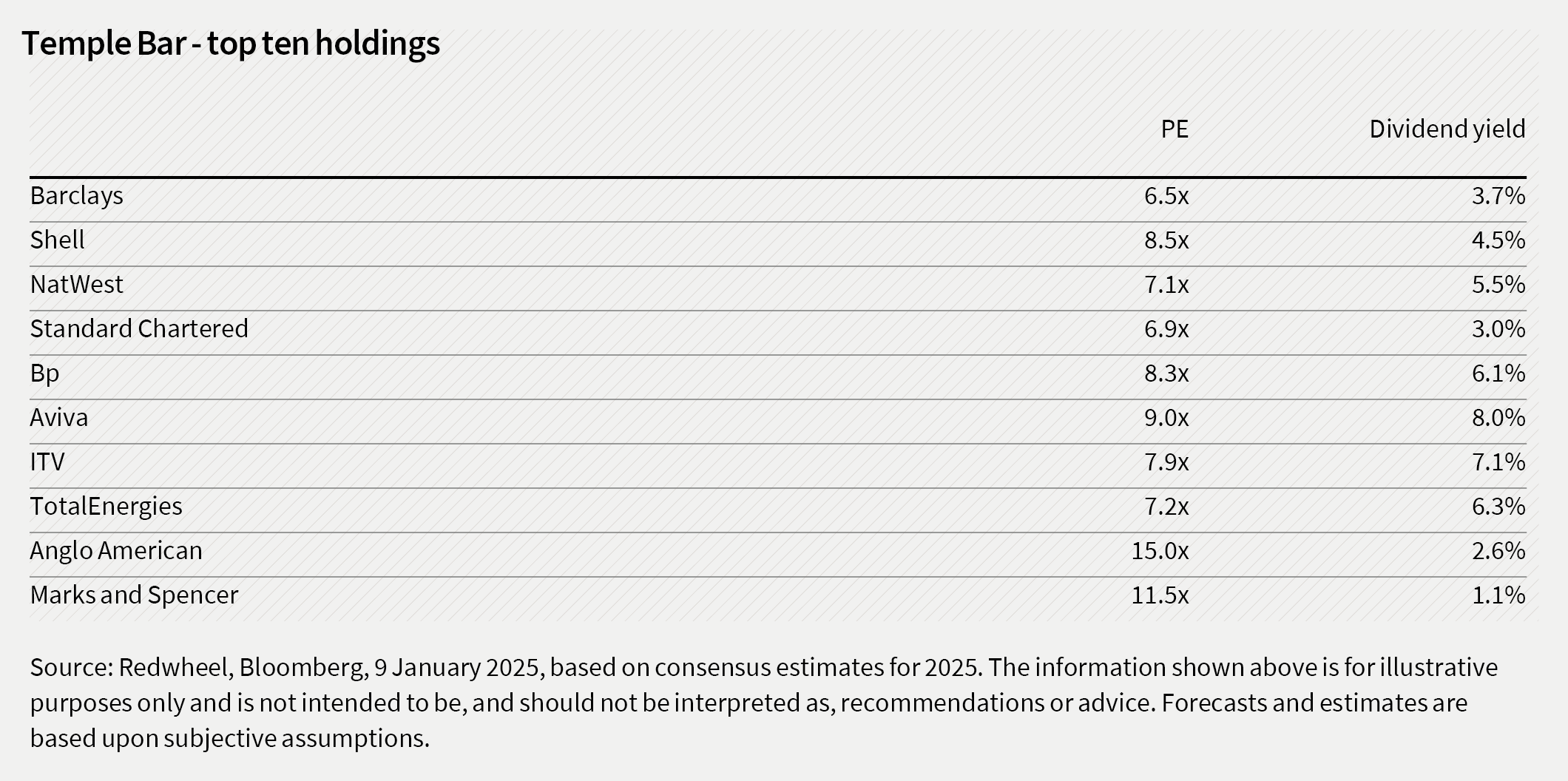

Despite the strong performance seen in 2024, we believe the valuations of the shares in the Temple Bar portfolio are still at very attractive levels, as demonstrated in the table below. This, more than anything else, should give investors optimism about the future long-term returns that these stocks could deliver.

Conclusion

In a world in which many investors seem obsessed with the large US technology companies (colloquially known as ‘The Magnificent Seven’), it is worth noting that some of the Temple Bar portfolio holdings produced returns last year that were on a par with them. And yet, in contrast to the reassurance we find in the low PEs and high dividend yields evident in the portfolio, the high valuations of the Magnificent Seven stocks should give investors pause for thought about how sustainable these returns can be.

To conclude therefore, in looking back at the returns delivered in 2024, we find considerable fundamental reasons for confidence when looking at what the Temple Bar portfolio can deliver for shareholders in 2025 and beyond.

1 The phrase ‘Barbarians at the Gate’ originates from the title of a book by Bryan Burrough and John Helyar, chronicling the aggressive leveraged buyout of RJR Nabisco in the late 1980s – it is now regularly used to describe opportunistic corporate takeover activity.

2 Source: Bloomberg, 9 January 2025. Past performance is not a guide to the future.

4 Judgment under uncertainty: heuristics and biases, Tversky and Kahneman, 1974

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. Information contained in this document should not be viewed as indicative of future results. The value of investments can go down as well as up.

This article is issued by RWC Asset Management LLP (Redwheel), in its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. Redwheel, is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission.

Redwheel may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. Redwheel seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by Redwheel are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by Redwheel; or (iv) an offer to enter into any other transaction whatsoever (each a Transaction). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party. Redwheel bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction.

How to Invest

The Company’s shares are traded openly on the London Stock Exchange and can be purchased through a stock broker or other financial intermediary.